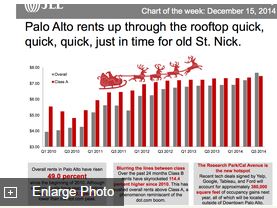

After stabilizing for much of the year, Palo Alto office rents are closing out the year on an up note, according to a new infographic from JLL.

After stabilizing for much of the year, Palo Alto office rents are closing out the year on an up note, according to a new infographic from JLL.

The city, considered one of Silicon Valley’s most desirable office markets, has seen rents overall climb 49 percent since the start of 2010, JLL says. The number for less-swanky Class B product? That’s zoomed even more, up 114.4 percent, JLL says.

Read the full story in the Silicon Valley Business journal here.

“We are in an outright boom; the strongest place in America.” Those were the resounding words spoken by Kenneth Rosen, chairman of the Fisher Center for Real Estate and Urban Economics at the Haas School of Business of the University of California, Berkeley, as he opened the center’s 19th annual conference, Monday, April 28, describing the state of the Bay Area real estate market.

“We are in an outright boom; the strongest place in America.” Those were the resounding words spoken by Kenneth Rosen, chairman of the Fisher Center for Real Estate and Urban Economics at the Haas School of Business of the University of California, Berkeley, as he opened the center’s 19th annual conference, Monday, April 28, describing the state of the Bay Area real estate market. The Carlyle Group is buying Lincoln Court, one of the few higher-end office complexes in Campbell, in a deal rumored to be roughly $41 million, or $335 per square foot. Principal Global Investors is the seller.

The Carlyle Group is buying Lincoln Court, one of the few higher-end office complexes in Campbell, in a deal rumored to be roughly $41 million, or $335 per square foot. Principal Global Investors is the seller. As the commercial building boom accelerates within the South Bay’s Golden Triangle district, the burgeoning North San Jose tech district bounded by highways 101, 880 and 237, future workers will be able to take advantage of new residential options rising in the surrounding regions and linked by bus, light rail and, in the near future, BART.

As the commercial building boom accelerates within the South Bay’s Golden Triangle district, the burgeoning North San Jose tech district bounded by highways 101, 880 and 237, future workers will be able to take advantage of new residential options rising in the surrounding regions and linked by bus, light rail and, in the near future, BART.